Weaponized Regulators: ransom edition II

Why would a quasi-governmental entity need an interest free loan from me?

Year-end Regulator Rant! (It’s a racket. And anyone deemed non-compliant will be treated to kangaroo court.)

If you’ve been following along with the Weaponized Regulators saga, you’ll immediately recognize this new weapon in their arsenal.

If you’ve not been following along with the twisting, winding, machinations: we’re coming up on a year of excruciating “examination” of my primary company. Several of us have been very active and vocal, pushing back against the “woke” agenda in K-12 education. Five of us are now or have gone through some manner of “examination” or “investigation.” A few were told that they’d had complaints against them, but were not allowed to know who had complained. None of us have had prior complaints. One of us has folded, the stress overwhelming her, and she has all but closed her business. We’re all in different lines of business. Three of us received nearly identical letters in March of this year telling us that our respective Regulators would be digging DEEP into our companies. My company and I, I’m told, are not under investigation and are not suspected of any wrongdoing; however, when I asked what right Regulators have to ask me to go back ten years in my records and ask me wave after wave of questions - each of which takes hours, days, or even weeks to prepare a response - I was provided legal code that allows them to dig deep into my company if we are suspected of wrongdoing. This means that my communications from the Regulators all assure me that this is routine, even though I’ve been through many of these and this is anything but routine, and yet they are relying on laws justify their actions that require I be under investigation. Circular, sticky, broken logic. But I have no choice but to play along if I hope to stay in business.

Now, a new wrinkle. Nonsensical payment collections.

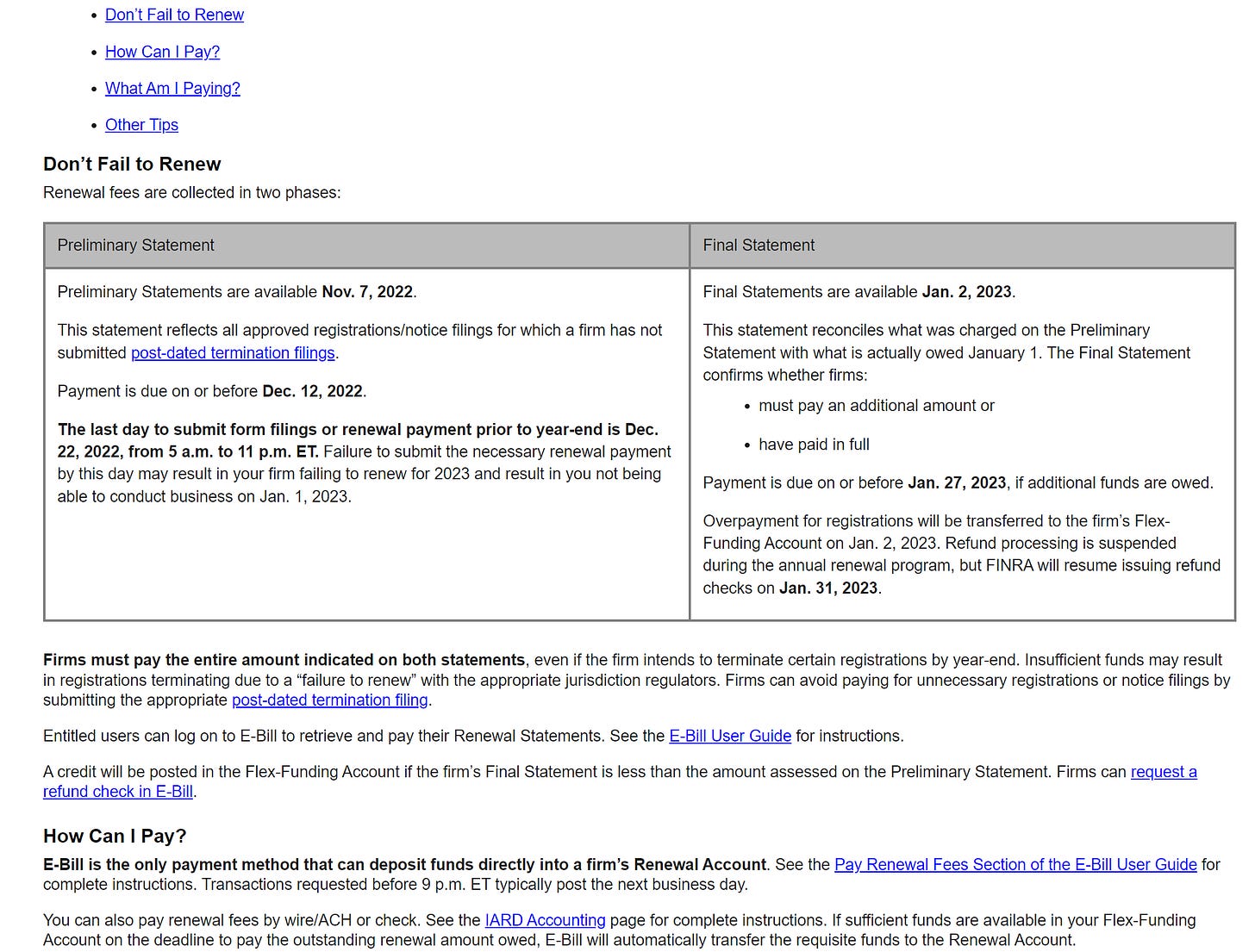

Regulators, it seems, calculate my renewal fees in November every year. Figuring out what’s owed and calculating the total is actually very difficult. So, all firms like mine over-estimate. All fees are collected by one firm and then distributed to everyone who collects fees in order for me to be permitted to do business in their jurisdiction. Different lines of business have different/additional fees; however, determining which lines of business apply to a small business like mine and in which instances, and which fees might be waived is extremely difficult.

Now enter the mandated interest-free loan that I am required to give to these Regulators. I call it Ransom. Once I make the adjustments and calculations, based upon my best understanding of what I believe the fees *should* be, then round up a little to be sure, and make payment… I will be considered in violation and “non-renewed.” Yep, that makes sense, right? I can over-pay, but be dinged for violating policy and non-payment if I do not pay the original estimate that was calculated in November.

Their answer, as if a simple shrug of the shoulders and “it’s the rules” attitude answers everything, is that I should over-pay by a huge amount, even though everyone knows it’s a huge over-payment, and then wait until sometime in January - some calendars suggest 31st - and request a refund. It’s almost as if they do not have computers, or the ability to apply mathematics. And refunds seem to have to wait a month, while they’re processing payments, as if there is one person working there who has to hand-deliver payments all over the U.S. Why, in 2022, when anyone can make nearly instant payment to anyone anywhere on earth is there a months-long process of mystery calculations and a requirement that any adjustment takes a month for the system to pick up?

I’m pretty sure I know the answer:

Based upon all that I’ve seen and experienced, I suggest that this is simply another big club with which to beat people, figuratively. This is another in a vast array of ridiculously overly-complex systems that often lead to misunderstanding and “non-compliance” which can be used to penalize and crush small business. Regulators as a tool of big-box mega-corporation, in other words. The only groups that can routinely navigate such systems are the mega-corporations, with their legal teams and lobbyists. Finance certainly isn’t alone in this - one of us works in construction, one nursing, one a psychologist… it’s the same story for us all.

For my part, I suspect I’m about to get slapped with a “Failure to Renew,” even though I sent more than the amount needed for my company weeks ago.

Oh, and by the way, changing the information that leads to the calculations is no easy task either. In order to get to my final calculation and then make the adjustments to notify various Regulators, I spent inordinate amounts of time on the clunky website before giving up and calling in for help.

This system is horribly broken.

- Jonathan

Images:

One of about one hundred communications I’ve received from Ohio Regulators this year. This came to me AFTER I’d already over-paid to renew my firm’s registrations.

From the website: